Wallstreetbets

Internet users take on ‘the Wall Street elites’

+ FOLLOW

Register and follow to be notified the next time content from Wallstreetbets is published.

A forum on Reddit where people discuss finances and where to invest their money. For some in the group, one goal is to "fight the system" - large financial firms and people with power and authority.

Latest News

News

Opinion

With hyperinflated sectors across multiple asset markets, the next crash could be so severe that it prompts a restructuring of global finance.

The politics around digital currencies have extended into the long-running battle for supremacy between the world’s major currencies.

Despite years of progress, the cryptocurrency is still in a vulnerable spot halfway between pure speculation and institutional adoption.

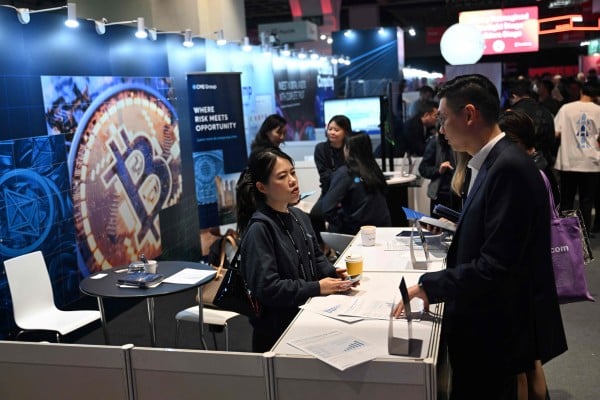

City has introduced groundbreaking, tailor-made laws designed to protect the public when investing in new class of financial products.

Crypto’s champions argue the technology offers unmatched transparency and security. But a closer look at the numbers tells a different story.

With bond yields rising and stock markets hitting precarious highs, gold-backed monetary policy could be a much-needed source of stability.

The finance world is in flux, with stablecoin issuer Tether investing heavily in the metal it has been trying to usurp as a primary means of exchange.

As the US allows 401(k) investors to access assets such as cryptocurrency and real estate, there seems to be little official recognition of the risks.

New framework strengthens Hong Kong’s position as a global digital asset hub by offering a sound regulatory environment.

With its coming licensing regime, Hong Kong must ensure its first-mover advantage in developing virtual-asset trading reinforces its position as a financial hub.

The stock market’s bullish sentiment amid tariff threats and hot wars feels a lot like the calm before a cataclysmic storm.

As mainland’s international operations centre, Shanghai will increase global reach of yuan, promote China’s central bank digital currency.

LOADING

Unfollowed

View all