Topic

Beijing again looks to Wu Qing, who cracked down on malpractice at brokerages, to bring a firm hand and pave way for new investment measures.

Some officials in the Chinese government are so desperate to get their desired narrative across that they have started to disregard basic principles, an approach which may carry a high cost in the long run.

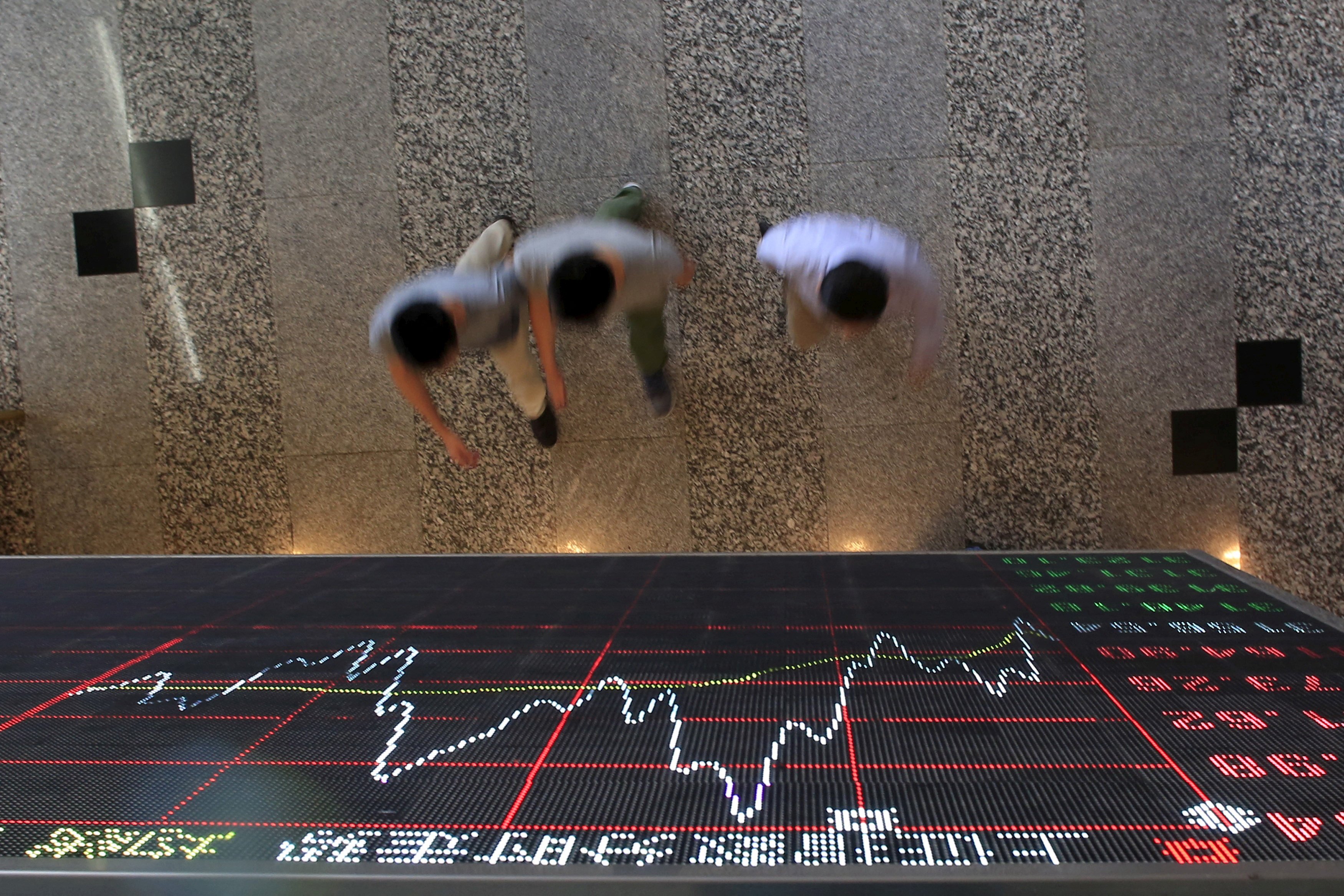

- Market is flashing technical overbought signals, which could deter further buying by global quant funds, US investment bank says

- The 14-day relative strength index of the Hang Seng Index shows that stocks are technically overbought and due for a pullback

‘Earnings are set to pick up as property activity stabilises and inflation recovery fuels household income and consumer spending growth,’ UBS strategist Meng Lei says.

Chinese regulators are scrutinising old business deals and bank accounts of senior executives as they ramp up inspections of stock-listing hopefuls. No companies have lodged IPO plans in Shanghai and Shenzhen this year.

Hong Kong stocks fell for the second straight day on Wednesday as investors awaited trade data which is expected to show both exports and imports returned to expansion territory in April, following a contraction in the previous month.

Swiss financial firm EFG has increased its investment in Chinese and other non-Japan Asian stocks, on expectations of steady growth in the region and driven by the belief the worst was over for stocks in China.

Hong Kong stocks decline from an eight-month high as traders cash in on the market bull run, while robust mainland tourism data for the holiday period fails to lift sentiment.

Investor sentiment has turned positive after a clutch of global investment banks made positive calls on Chinese stocks amid expectations of more policy support from Beijing.

Investment banks including Goldman Sachs, UBS and BNP have become more positive on Chinese stocks, with foreign selling having subsided. But the property crisis, deflationary risks and tepid consumer demand mean global investors are yet to go all ‘all in’.

A dovish US Federal Reserve and a gigantic share buy-back programme from Apple lifted Hong Kong stocks with sentiment remaining upbeat after China’s top policymakers signalled further support to economic growth.

Mainland China investors will gain access to Hong Kong’s Reits via an expanded mutual market access scheme in a move which will deepen the market, enhance its liquidity and attract international issuers, analysts say.

Foreign investors loaded up on Chinese stocks for a third straight month in April, adding to evidence that global fund managers have become more positive about the world’s second-largest market.

Hong Kong stocks emerged as the best-performing key market globally in April, after funds sought bargains by shifting out of expensive US and Japanese equities and as China’s growth shows more signs of stabilising.

Hong Kong’s market is the best performer among major peers globally this month, and better-than-expected manufacturing activity in mainland China is expected to add further impetus.

Hong Kong stocks closed near bull market territory after corporate earnings continued to surprise on the upside with property sector support measures on mainland China adding to the momentum.

CICC cuts pay amid brutal business environment as a sluggish economy and dismal IPO volumes hurt the financial services sector.

Chinese local government entities have carried the mantle of cornerstone investors in first-time stock offerings in Hong Kong in the past two years as foreign investors shun deals. Their outsize role could work against the city’s capital market, market experts say.

Investigation into Yao Qian, who serves as the director of the department of technology supervision at the China Securities Regulatory Commission, comes amid an uptick in market reforms.

Guolian Securities plans to buy a 95.48 per cent stake in unlisted Minsheng Securities, in an acquisition that is expected to make it a top-20 brokerage.

Hong Kong stocks rose and completed its best weekly performance since October 2011 as positive earnings from top-tier Chinese companies and supportive policy measures boosted investor confidence

Global investors turn constructive on Chinese stocks after a series of stock market reforms aimed at strengthening scrutiny and boosting returns to shareholders.

Hong Kong stocks rise on optimism that the appetite for Chinese assets is returning as Beijing pledges support to markets and signs of an earnings recovery emerges.

Hong Kong stocks rose for a third day after earnings optimism drove the benchmark Hang Seng Index to a five-month high.

Goldman says Chinese stocks may rise 40 per cent amid ‘more conducive trading environment’ in near term, while UBS raises ratings on Chinese and Hong Kong stocks to overweight.

Chabaidao’s stock ended the day 27 per cent lower after slumping as much as 38 per cent. It raised about HK$2.6 billion (US$331.7 million) from the sale of 147.8 million shares at HK$17.50 each.

Role of fund managers will be strengthened as cost of rule violations increases ‘substantially’, a lawyer says, while Goldman Sachs predicts higher ‘quality premium for large-cap stable growers’.

Hong Kong stocks climbed most in three weeks as investors ramped up their buying on expectations that a slew of supportive measures from the Chinese securities watchdog will aid sentiment.

Hong Kong stocks extended gains amid expectations the latest measures announced by Chinese authorities will broaden the investor base