Advertisement

Advertisement

TOPIC

Capital gains tax

Capital gains tax

A capital gains tax (CGT) is a tax on capital gains, the profit realised on the sale of a non-inventory asset that was purchased at a lower price. The most common capital gains are realised from the sale of stocks, bonds, precious metals and property. Not all countries implement a capital gains tax and most have different rates of taxation for individuals and corporations.

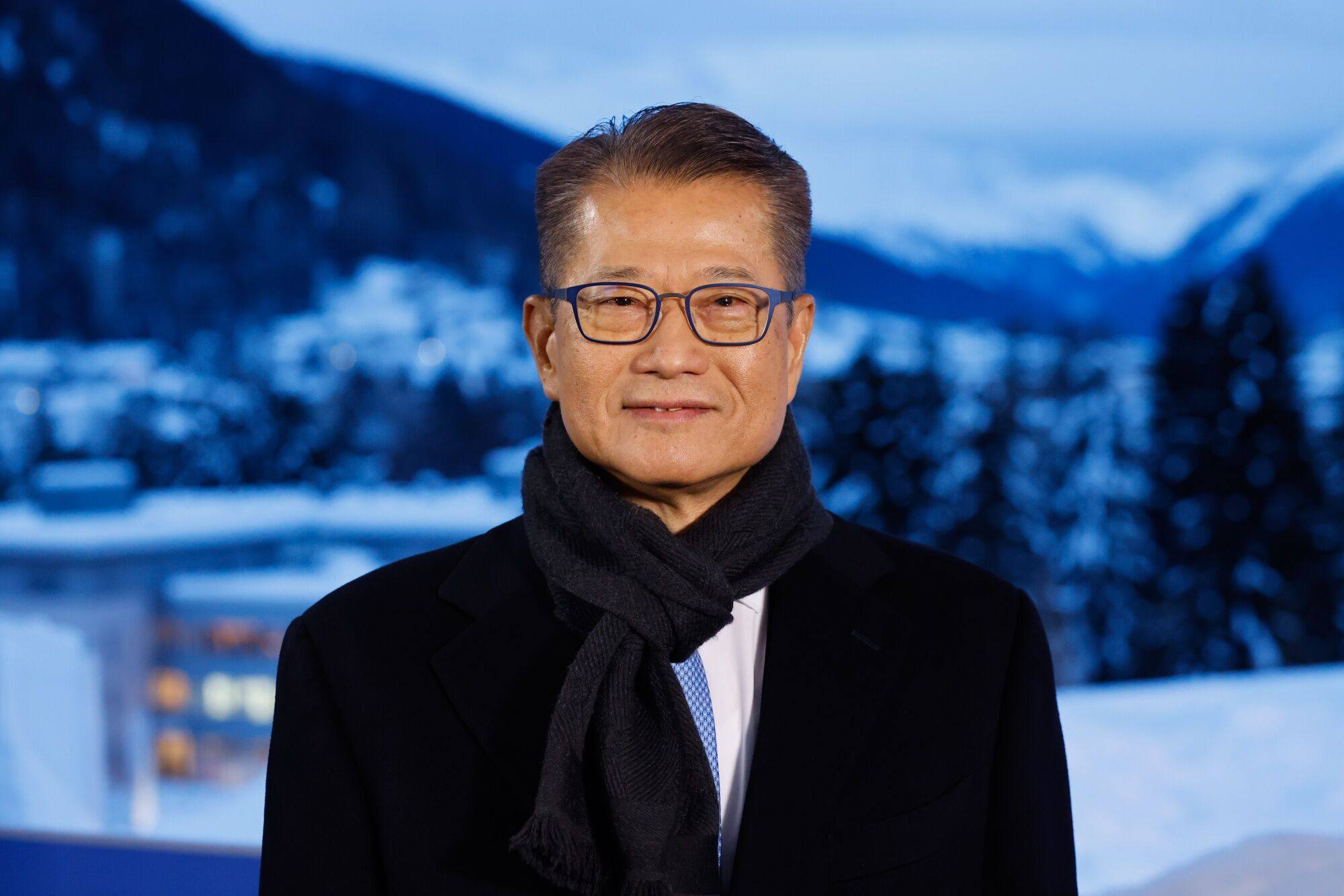

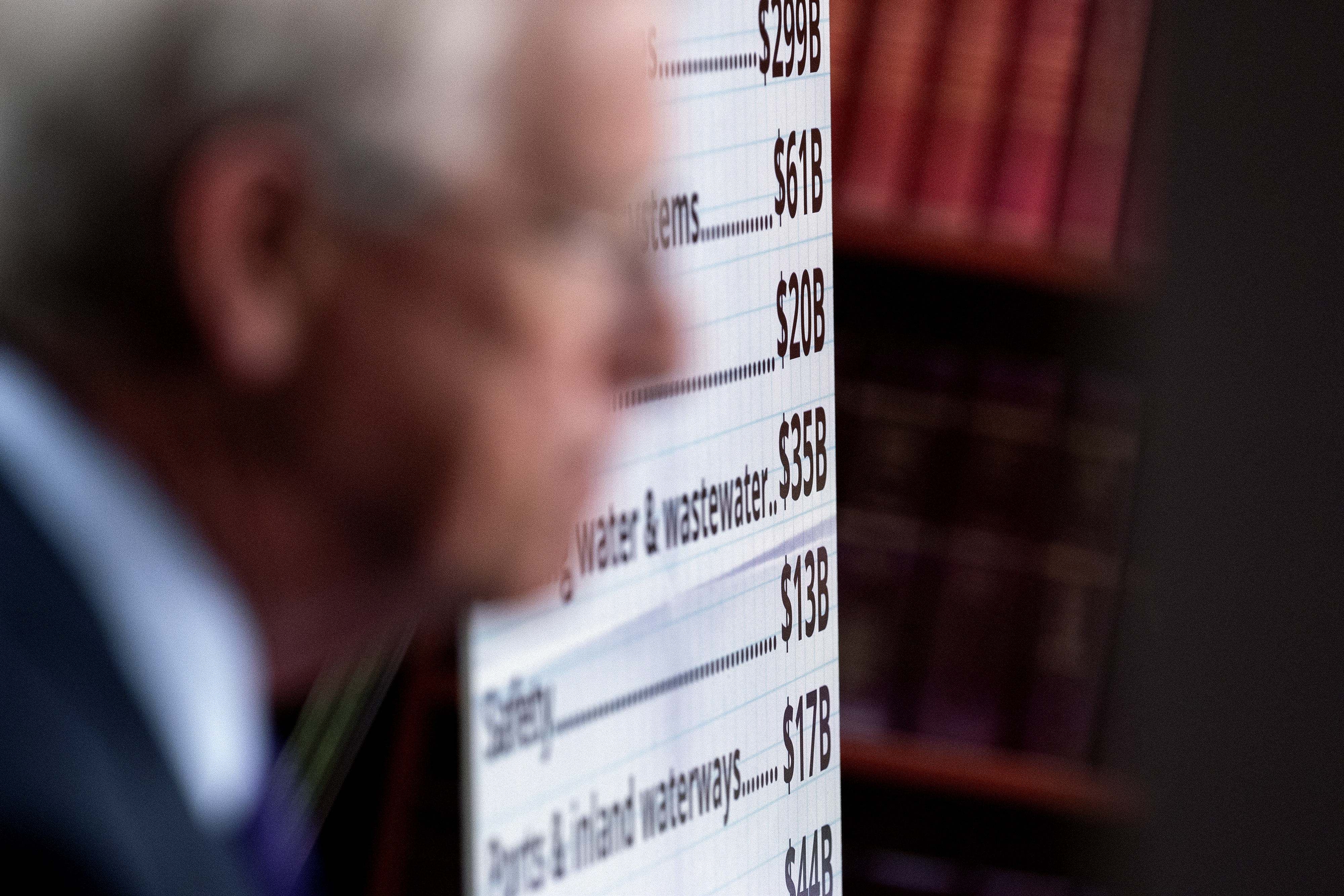

Opinion | Why it’s time for Hong Kong to go the way of Singapore on GST

With the city facing a massive deficit, it must prioritise spending where it matters and find new sources of revenue. A goods and services tax implemented at the wholesale level might not be too onerous, and would reassure investors in government bonds of the city’s financial health.

Advertisement

Advertisement

Advertisement

Help preserve 120 years of quality journalism.

SUPPORT NOWAdvertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement