TOPIC

Chinese housing market

Chinese housing market

Chinese housing market

Advertisement

Advertisement

Advertisement

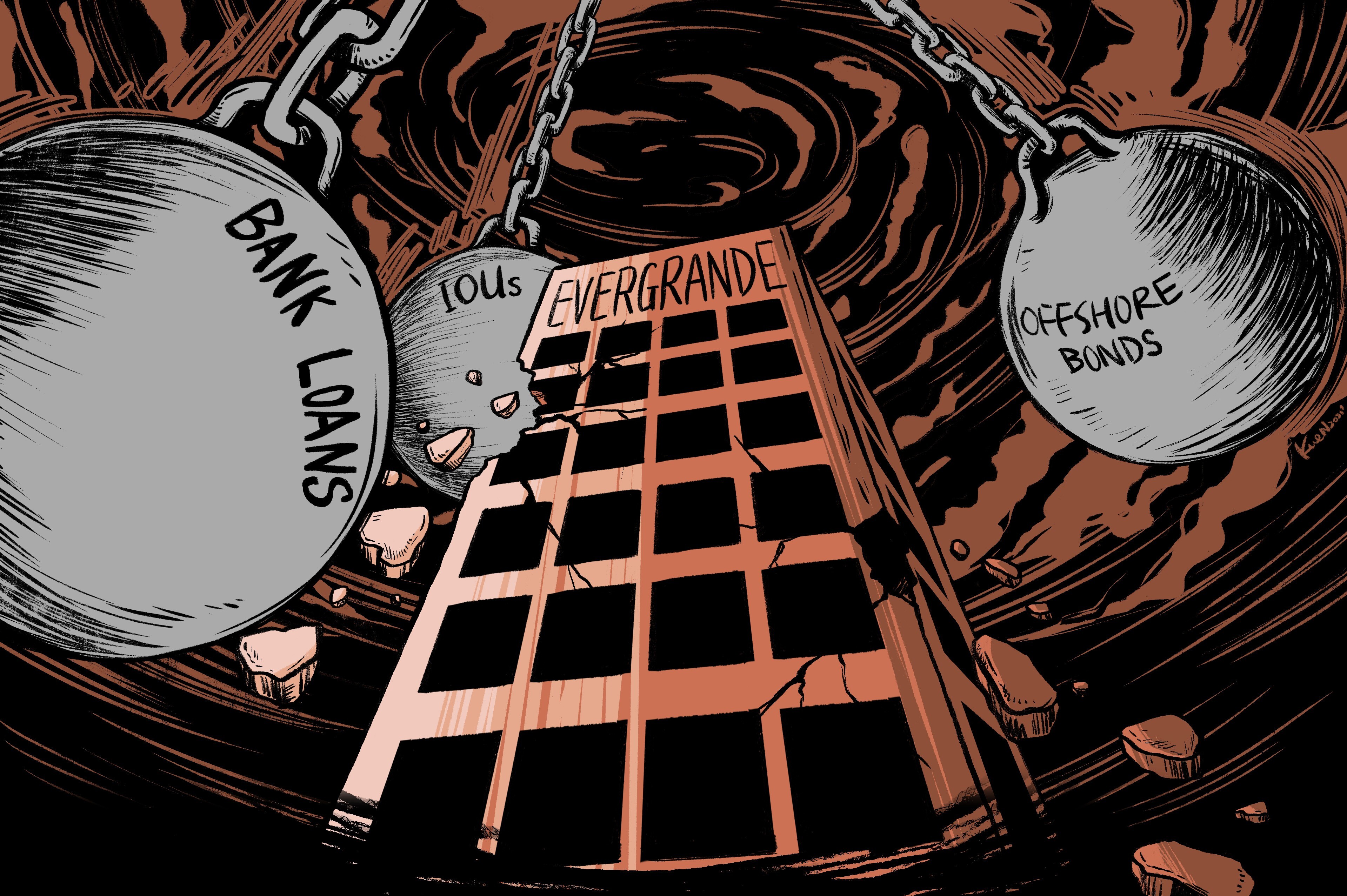

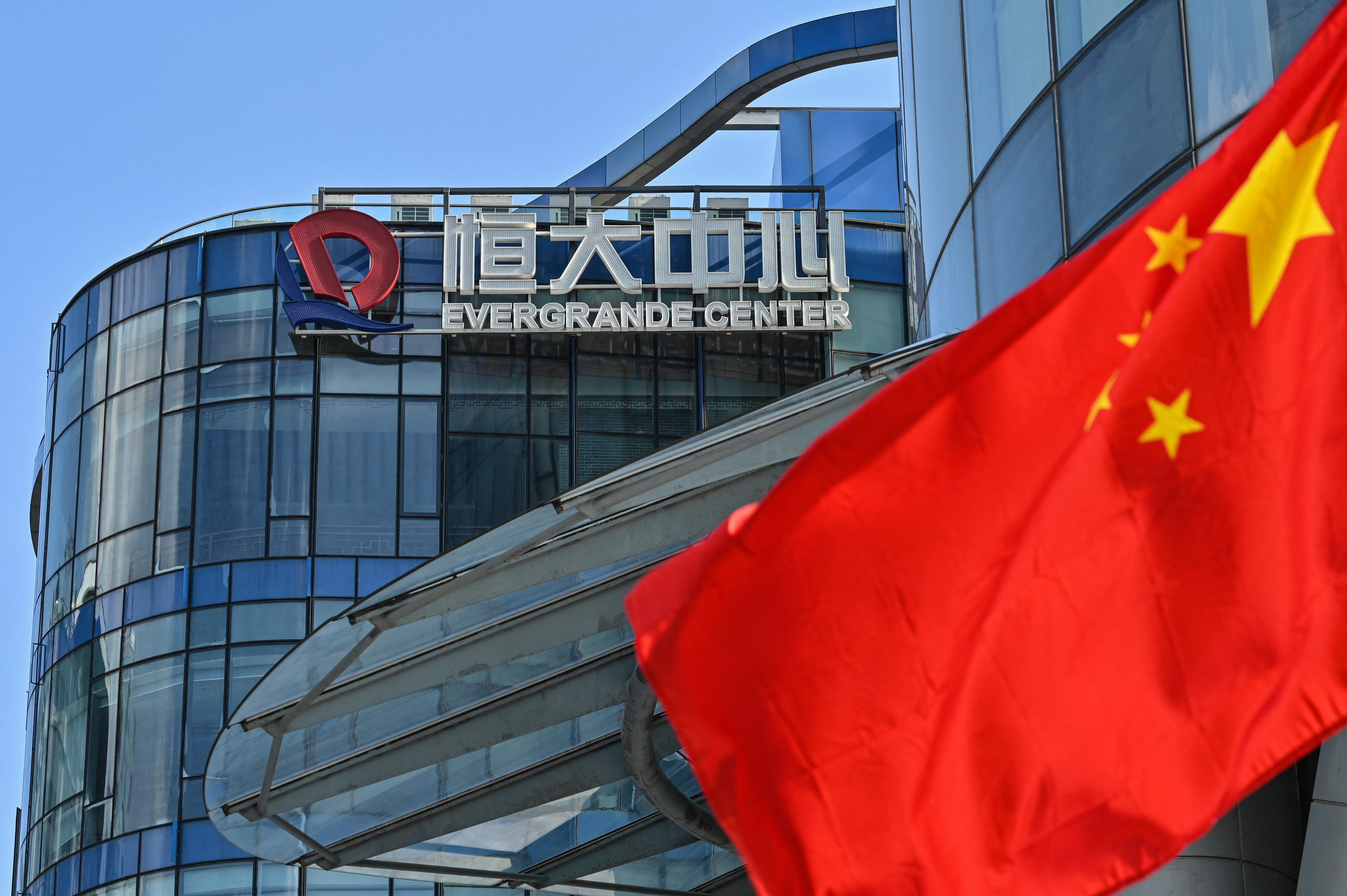

Macroscope | Beyond Evergrande crisis: why China still has strong investment appeal

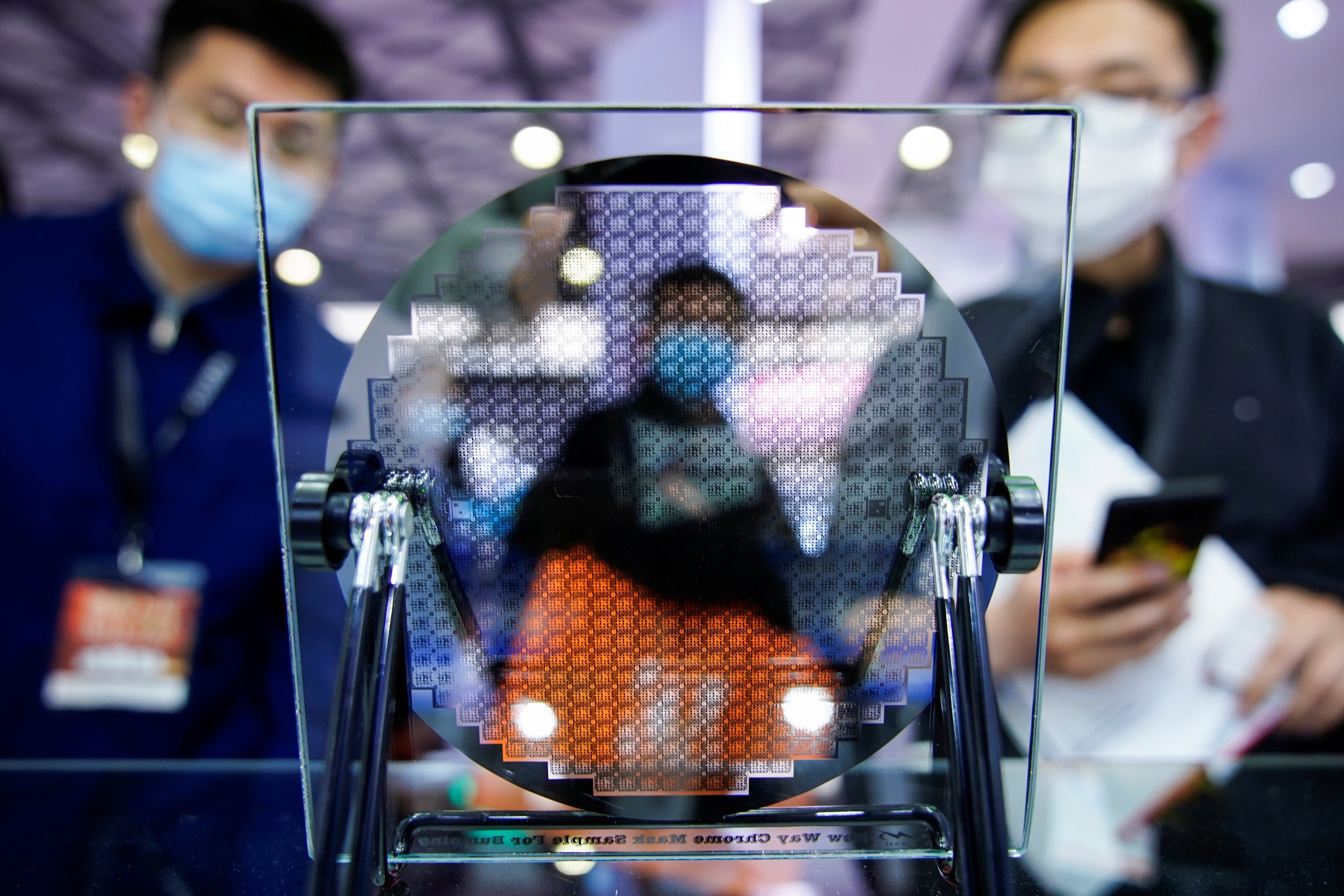

Away from the Evergrande debt crisis and the real estate sector, there are still opportunities in the industries Beijing wants to see expanded. Notably, China’s recent tech crackdown did not extend to industries it is championing, like semiconductors.

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Help preserve 120 years of quality journalism.

SUPPORT NOWAdvertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement