Topic

Latest news and analysis about companies owned or founded by Chinese entrepreneurs, listed on the New York Stock Exchange (NYSE) or Nasdaq.

As Beijing halves stamp duty on share deals to lift investor confidence, Hong Kong is seeking greater liquidity to strengthen its position.

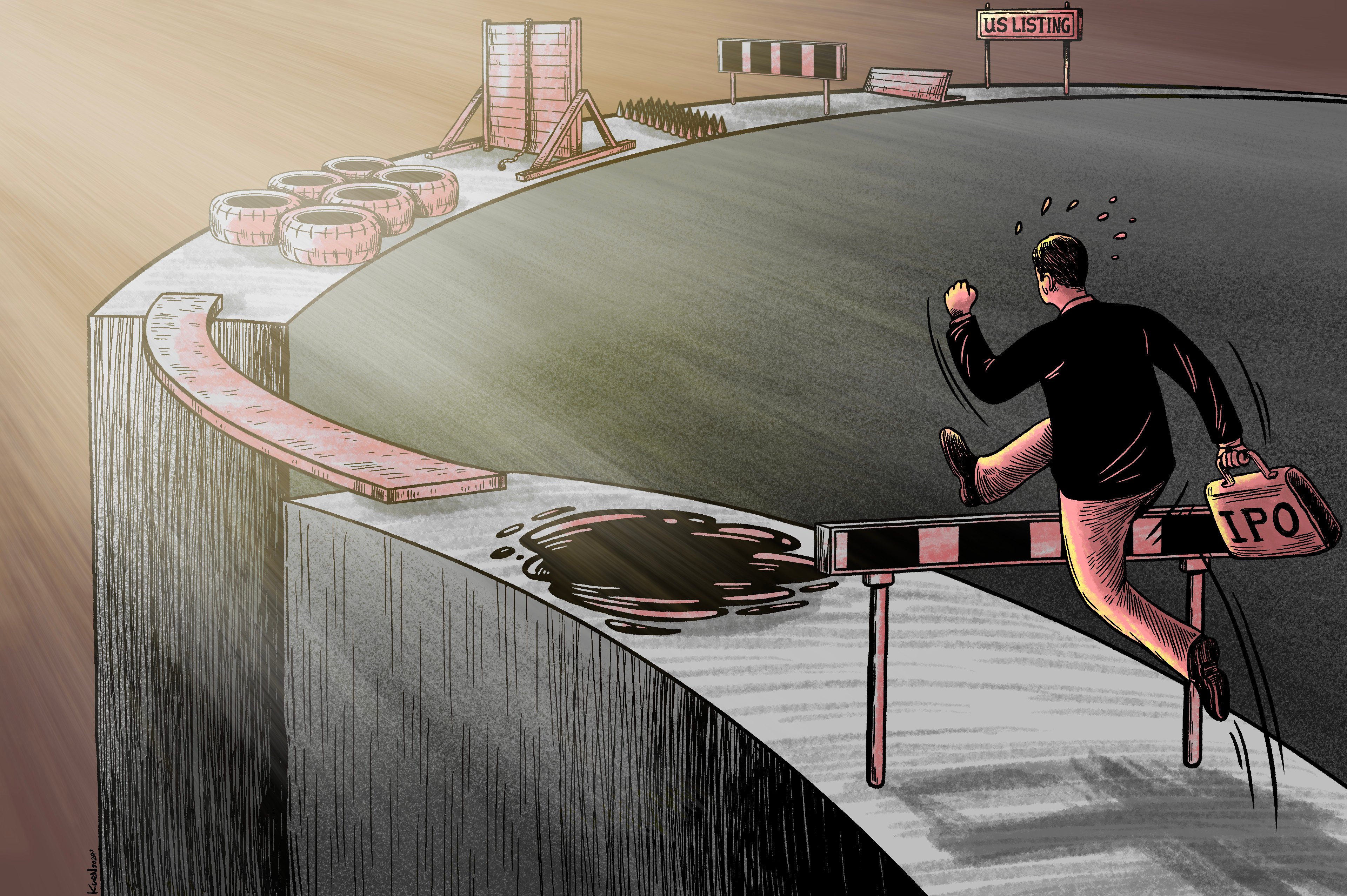

New rules from the China Securities Regulatory Commission aim to bring transparency and end chaotic process that left such offerings mostly unregulated.

US auditing in city of Chinese firms facing delisting from New York exchange passes first test, but there is still some way to go .

Agreement set to benefit investors, companies and both great economies, which faced entering uncharted territory of financial decoupling.

Primary listing in Hong Kong by tech giant will allow ordinary people to share in success of such companies and help drive nation’s development.

- Chinese local government entities were cornerstone investors in a third of Hong Kong IPOs between January 2023 and March 2024 as private funds stayed away

- Too much state-linked involvement is frowned upon by investors as it could distort supply and demand and weaken market discipline

‘There is an increasing demand for diversification from domestic Chinese customers,’ says Joseph Pinto, CEO of London-based money manager M&G Investments.

Hong Kong stocks fell on Friday as investors were rattled by reports of Israeli missiles hitting Iran, with the heightened Middle East tensions triggering a scramble for safe haven assets.

The erratic performance of Chinese stocks is not giving investors the confidence to commit their funds for the long haul, so some are betting on proxies outside the country, according to top wealth managers.

Geopolitics is the biggest uncertainty and foreign interest in Chinese assets will depend on the direction of Beijing’s next set of policies, according to executives at the Harvard College China Forum.

Hong Kong stocks declined to three week-lows as rising geopolitical tensions dealt a further setback to investor sentiment, already jittery ahead of a batch of economic data due to be released during the week.

Alibaba scales back an ambitious business overhaul plan and bids farewell to a turbulent year, as its founders call on employees to embrace changes.

There is nothing to fear from missteps because nobody is error-free, Ma wrote, after his co-founder Joe Tsai touched on Alibaba’s mistakes in a podcast interview, generating a frenzy on China’s social media.

Alibaba Group spent US$4.8 billion to repurchase its own shares in Hong Kong and New York last quarter, the most since late 2021, to boost returns to shareholders.

Hong Kong stocks retreated after expectations of rate cuts by the US Federal Reserve were dealt a setback by strong jobs and factory orders data in the world’s biggest economy.

‘The time to buy is when everyone hates the market and it’s cheap, which is now the case in Chinese equities,’ especially as there are signs that the country’s economic leaders are preparing stimulus measures, the hedge fund billionaire said in his LinkedIn blog.

Has China’s long march to recouping stock market losses begun, after a US$1.75 trillion bounce in value from January lows? Many sentiment indicators have reached inflection points, backstopped by state intervention. Or do market bears still hold sway?

Hong Kong stocks made a firm start after the US Federal Reserve’s dovish outlook brightened the prospects of lower funding costs in the months ahead.

From April 1, EHang’s EH216-S electric vertical take-off and landing vehicle will be available in overseas markets at a suggested retail price of US$410,000.

Investors should seek refuge in Chinese domestic consumption stocks and avoid hardware and semiconductor makers to ride out the US-China geopolitical uncertainty, according to Goldman Sachs.

Once a lucrative source of fees for investment bankers, new stock offerings have become a source of stress and job insecurity amid a slump in activity. For retail investors, those first-day windfalls are also harder to come by.

Hong Kong stocks rose, amid expectations global central banks will ease monetary conditions this year following dovish comments from heads of the US Federal Reserve and the ECB.

Hong Kong stocks slumped amid worries the targets set by Beijing was a signal by authorities about the economic headwinds in China.

Money managers and analysts are confident of further upside in China’s onshore stock market after a stellar run in February, as they anticipate some policy catalysts.

Futu accelerates its international market expansion to seek new growth with its Malaysian foray on the heels of its Singapore expansion, as China tightens regulations on mainland investors’ overseas securities trading to curb capital outflow.

DAB says more stock exchange listings from mainland would boost city’s standing as major financial centre and increase global profile of Chinese companies

China’s stock market divided global funds last quarter, according to 13F filings. Bridgewater pared more of its holdings, while Temasek and PIF stayed the course. Michael Burry’s Scion topped up bets on Alibaba and JD.com.

Stocks gained for a second day after a wobbly start. Some US funds have loaded up on Chinese tech companies, while others in the region showed no urgency to chase the recent market rally.

Local stocks are set for an auspicious start to the Year of the Dragon as gains in Tencent, Alibaba and Galaxy overcome early jitters. Chinese firms suffer the brunt of deletions in MSCI’s latest review of its global indices.

Report by US-China Economic and Security Review Commission finds the value of roughly 256 Chinese companies on US markets slid 17.5 per cent from 2022.

Once a license to print money, Chinese initial public offerings have been tarnished by opaque finances, scandals and Didi Global’s sudden NYSE delisting in 2022.

‘People are interested in India for several reasons, one is simply it’s not China,’ says Vikas Pershad, a money manager at M&G Investments in Singapore. ‘There’s a genuine long-term growth story here.’

Stocks advanced, adding to a rebound last week on bets China will deliver more supporting measures. China Evergrande slumped after losing a winding-up litigation in Hong Kong.

The bill cites Chinese entities such as Third Military Medical University and Key Laboratory of High-Altitude Medicine as examples of ‘espionage tools’ of the Communist Party.

The Hang Seng Index marked its first winning week of the year, but the gains were trimmed to 4.2 per cent. Geopolitical risks will continue to be an overhang as this is an election year, Dickie Wong of Kingston Securities says.

.jpg?itok=3ECIw2rc&v=1674178248)