Tech stocks Tencent and Alibaba made solid gains to close the day on a high

Trump halts contributions to WHO, saying his administration will conduct an inquiry into the UN agency's ‘role in severely mismanaging and covering up the spread’ of the coronavirus

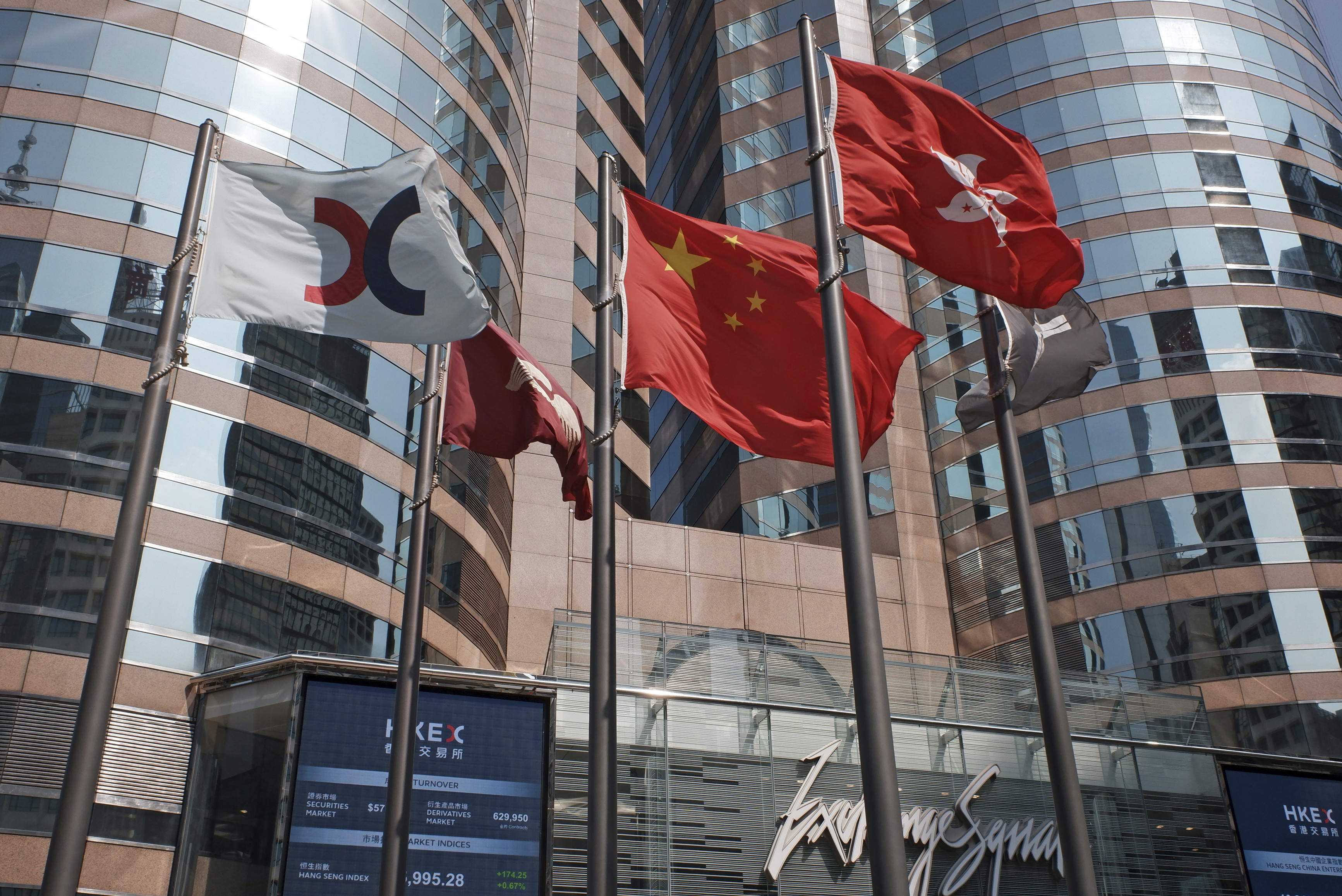

Proceedings in the Hong Kong were once again dominated by the China coronavirus outbreak, as shares fell for a third consecutive day.

Fears over the novel coronavirus dominated proceedings for a second consecutive day, as investors expect a big impact on China's economy.

Hong Kong shares closed the first trading session of the Year of the Rat with a loss of 2.82 per cent amid fears over the Wuhan virus

US markets once again end at record highs with Alphabet becoming the latest member to join the US$1 trillion club

It was a day of chopping trading in Hong Kong, with the benchmark fluctuating between losses and gains throughout the day.

Hong Kong and mainland stocks fell for a second straight day as investors moved to the sidelines amid lingering concerns over the US-China trade deal that will be signed later tonight in Washington.

The Hong Kong and China markets were unable to maintain the initial momentum provided by overnight gains on Wall Street and the US Treasury removing its designation of China as a currency manipulator.

Hong Kong investors shrugged off disappointing US employment data, while Taiwan stocks rose to a near three-decade high after President Tsai Ing-wen won a landslide victory in the re-election.

Financials, property developers and tech shares advance broadly.

Hong Kong is closed today for Christmas holiday; trading resumes tomorrow

Chip makers extended a two-day rally on renewed optimism over state fund support, while liquor makers fell on concerns over food safety and high valuation.

Trading in Hong Kong, which was open only for half a day today, will now resume on Friday after the two-day Christmas break.

Shanghai Composite closes 3,000 level for the first time since December 17

Turnover falls in Hong Kong ahead of Christmas holiday

Hong Kong's Hang Seng Index continued last week’s declines as a lack of progress in trade talks and ongoing protests played on investors’ minds

Shanghai Composite Index slips to lowest level since September 2, while ChiNext falls the most in four months

There are not many catalysts to make the Hong Kong market go any higher, says Louis Wong, director of Phillip Capital Management

Hong Kong's benchmark index ends 0.87 per cent lower

UBS further cuts its Hong Kong GDP forecast for 2019 to 0.4 per cent from 0.8 per cent

Analysts predict 19 per cent decline in Hong Kong companies' operating profit

Trump says 'I'm not ready to make a deal with China'

Sun Hung Kai Properties and Wharf Real Estate Investment both fell by as much as 2.6 per cent

Jefferies sees 'limited downside' for Hong Kong stocks despite ongoing political storm